During my CPA career I have seen business owners shirking their responsibility to withhold and pay federal income taxes, too many times. The taxes can be both federal and state. On the federal side, FICA (social security), Medicare, income taxes, and unemployment insurance (FUTA) can add up to large amounts that these employers cannot seem to part with when their business is in a bind. Penalties and interest usually compound the problem.

During my CPA career I have seen business owners shirking their responsibility to withhold and pay federal income taxes, too many times. The taxes can be both federal and state. On the federal side, FICA (social security), Medicare, income taxes, and unemployment insurance (FUTA) can add up to large amounts that these employers cannot seem to part with when their business is in a bind. Penalties and interest usually compound the problem.

Not only are the owners responsible, but any “responsible party.” See The Consequences of willful failure to pay payroll taxes by Vani Murthy for a more comprehensive discussion on the responsible party. There has been limitations on who these people are, but just because you delegate the duty does not mean you are off the hook. If you are the owner or officer, the responsibility may put your personal assets at risk. Worse yet, in the most egregious cases, the IRS has imposed criminal penalties including jail time.

So, what can a business owner do to avoid falling into this situation? And, if in it, what can they do?

- Manage your cash flow: This is always the first step. Too many business owners look at payroll taxes as a necessary evil that can be placed on the back burner. Instead, place this item at the top of your cash disbursements along with the payroll. Pay them at the same time as your payroll, not the 15th of of the following month, or any time before that just because it is mandated by law.

- Defer your personal payroll to the next month: As a small business owner, if you can personally afford paying yourself for a few weeks, defer your personal paycheck to the next month. That can be only one day when you pay payroll on the last day of the month. This could delay your payroll tax liability due date.

- Understand the danger signs: If you are using your business credit line to “make payroll,” then your business model is probably broken. It could be for a number of reasons: Uncollectible receivables, too low of a gross profit ratio, unproductive sales employees are just to name a few. I have seen all of these sink businesses.

- Talk to the IRS: If you find your company without funds, rectify the problem as stated above but also open a dialog with the IRS. Keep the communication open and implement a payment plan for back taxes. This may keep them from levying your bank account thus sabotaging any efforts to save your business.

- Take your head out of the sand: There is a type of business owner that I have come across that uses the ostrich method. They just put business problems out of their mind and don’t plan on rectifying them. When I would make recommendations they would delay until forgotten. Please try to avoid this.

Meeting a challenge before it happens, and after it happens will usually be the best route to take with payroll taxes. Since all situations are unique, please consult a tax adviser before making any decisions.

______________________________________________________________________________

IRS CIRCULAR 230 DISCLAIMER: To ensure compliance with requirements imposed by the U.S. Department of the Treasury and Internal Revenue Service, we inform you that any tax advice contained in this e-mail (including any attachments) is not intended or written to be used, and may not be used, for the purpose of (a) avoiding penalties under the Internal Revenue Code or state tax authority, or (b) promoting, marketing, or recommending to another party any transaction or matter addressed herein. Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties. If desired, (Firm) would be pleased to perform the requisite research and provide you with a detailed written analysis. Such an engagement may be the subject of a separate engagement letter that would define the scope and limits of the desired consultation services.

Some people that are retired do not have access to tax advice. One question that arises is whether their social security benefits are taxable? The answer is “maybe.” Here are some guidelines from the IRS and a link to help you find the answer.

Some people that are retired do not have access to tax advice. One question that arises is whether their social security benefits are taxable? The answer is “maybe.” Here are some guidelines from the IRS and a link to help you find the answer. The media has not shown the IRS in a favorable mood, lately. However, taxes are here and you probably pay them. Many tax questions I am asked would have been answered by the questioner if they just understood the basic premise of how our tax system work. This understanding may have also helped these people in their personal financial decisions.

The media has not shown the IRS in a favorable mood, lately. However, taxes are here and you probably pay them. Many tax questions I am asked would have been answered by the questioner if they just understood the basic premise of how our tax system work. This understanding may have also helped these people in their personal financial decisions. Years ago I was representing a screenwriter before an IRS audit. We did not prepare the

Years ago I was representing a screenwriter before an IRS audit. We did not prepare the What!? I couldn’t believe the recorded message. A Fortune magazine writer left me a message requesting my opinion on the tax treatment of some rappers deducting tens of thousands of dollars on strippers. After a few comedic quips, I actually answered his questions. I forgot the whole interview took place until this:

What!? I couldn’t believe the recorded message. A Fortune magazine writer left me a message requesting my opinion on the tax treatment of some rappers deducting tens of thousands of dollars on strippers. After a few comedic quips, I actually answered his questions. I forgot the whole interview took place until this:  A new Additional Medicare Tax goes into effect starting in 2013. The 0.9 percent Additional Medicare Tax applies to an individual’s wages, Railroad Retirement Tax Act compensation, and self-employment income that exceeds a threshold amount based on the individual’s filing status.

A new Additional Medicare Tax goes into effect starting in 2013. The 0.9 percent Additional Medicare Tax applies to an individual’s wages, Railroad Retirement Tax Act compensation, and self-employment income that exceeds a threshold amount based on the individual’s filing status. Have you ever heard of Pacific Ocean Park? (P.O.P. as we kids used to call it). I grew up in Los Angeles during the 1960s and would go down to that amusement park in Santa Monica. It was a real old fashioned park consisting of a fun house, house of mirrors, fortune tellers, etc. One of my favorites was the house of mirrors. My cousin, Bill and I would always try to figure out a system on navigating through it. We had no directions, or secret knowledge, so we had to wing it.

Have you ever heard of Pacific Ocean Park? (P.O.P. as we kids used to call it). I grew up in Los Angeles during the 1960s and would go down to that amusement park in Santa Monica. It was a real old fashioned park consisting of a fun house, house of mirrors, fortune tellers, etc. One of my favorites was the house of mirrors. My cousin, Bill and I would always try to figure out a system on navigating through it. We had no directions, or secret knowledge, so we had to wing it. As CPAs, every year we acquire clients who need help negotiating with the IRS regarding their back taxes. This apparently seemed to be such a problem, that the IRS has actually made it a little easier to satisfy the debt. It’s called the “Fresh Start” which offers more flexible terms in paying your taxes using its Offer-in-Compromise Program. I gathered this information from the IRS Tax Tips–July 9, 2012.

As CPAs, every year we acquire clients who need help negotiating with the IRS regarding their back taxes. This apparently seemed to be such a problem, that the IRS has actually made it a little easier to satisfy the debt. It’s called the “Fresh Start” which offers more flexible terms in paying your taxes using its Offer-in-Compromise Program. I gathered this information from the IRS Tax Tips–July 9, 2012. I remember the days when our young ones were in childcare. We would allot the maximum amount allowed under my wife’s flexcare (or cafeteria) plan in order to deduct as much of childcare on our tax return.

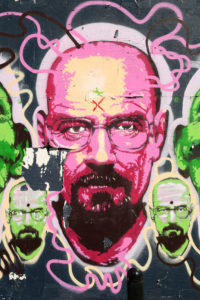

I remember the days when our young ones were in childcare. We would allot the maximum amount allowed under my wife’s flexcare (or cafeteria) plan in order to deduct as much of childcare on our tax return. Believe it or not, I don’t watch TV very much. However, my wife and son sat me down to watch the series Breaking Bad. We are on episode 13 of the drama spotlighting a cancer-stricken high school chemistry teacher turned methamphetamine manufacturer. The acting is superb.

Believe it or not, I don’t watch TV very much. However, my wife and son sat me down to watch the series Breaking Bad. We are on episode 13 of the drama spotlighting a cancer-stricken high school chemistry teacher turned methamphetamine manufacturer. The acting is superb.